Jamaica to roll-out digital currency

According to Euro News, Jamaica is part of a worldwide pilot scheme to launch digital currency this year. The Central Bank Digital Currencies (CBDC) is essentially electronic cash. Like traditional fiat currencies, it gives holders a direct claim on the central bank and allows businesses and individuals to make electronic payments and transfers.

What Is The Difference Between Digital Money And Online Banking?

Digital money according to Investopedia, is similar in concept and use to its cash counterpart in that it can be a unit of account and a medium for daily transactions. But it is not cash. For example, the dollars in your online bank account are not digital money because they take on a physical form when you withdraw them from an ATM

Digital money (or digital currency) refers to any means of payment that exists in a purely electronic form. Digital money is not physically tangible like a dollar bill or a coin. It is accounted for and transferred using online systems. One well-known form of digital money is the cryptocurrency Bitcoin.

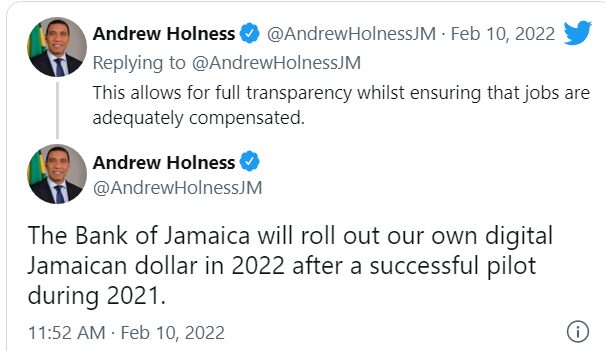

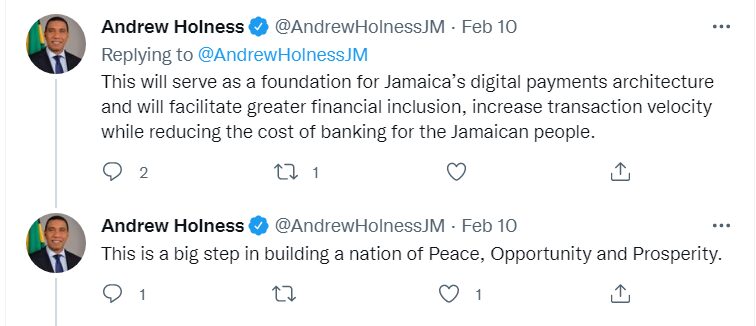

On February 10, 2022, Prime Minister Andrew Holness put out a series of Tweets in regards to Jamaica’s path to Digital Currency. He wrote, The Bank of Jamaica will roll out our own digital Jamaican dollar in 2022 after a successful pilot during 2021.

Jamaica

Jamaica’s prime minister Andrew Holness confirmed that the Bank of Jamaica will roll out a digital Jamaican dollar in 2022 following a successful pilot last year.

“This will serve as a foundation for Jamaica’s digital payments architecture and will facilitate greater financial inclusion, increase transaction velocity while reducing the cost of banking for the Jamaican people,” he said on Thursday.

As part of the test project, J$230 million (€1.28 million) worth of digital currency was minted. 57 customers conducted person to person, cash-in and cash-out transactions and this included transactions with small businesses such as a local craft jeweller.

“The majority of Jamaicans are financially excluded,” Natalie Haynes, a deputy governor with Bank of Jamaica for banking and currency operations and financial markets infrastructure, told Reuters in an interview in January of 2022.

“To get those persons into the formal financial system, we decided that the central bank digital currency would be a good opportunity.”

Haynes said the bank hopes to replace 5% of Jamaican dollars with the new digital currency each year~ Reuters. According to this report, if Jamaica hopes to replace 5% of the Jamaican dollars with the new digital currency each year, the Jamaican economy could be using full digital currency in 20 years.

According to Reuters, Jamaica’s digital currency follows a similar program by a group of Eastern Caribbean nations launched last year called DCash. Antigua and Barbuda, Grenada, Saint Kitts and Nevis, Saint Lucia and Saint Vincent are now using DCash. In 2020, Bahamas was the first country in the region to issue digital currency. ($1 = 155.8900 Jamaican dollars)

KEY TAKEAWAYS

- Digital money is money in purely digital form. It is not a physically tangible asset like cash or other commodities like gold or oil.

- Digital money can streamline the current financial infrastructure, making it cheaper and faster to conduct monetary transactions. It can also ease monetary policy implementation by central banks.

- Examples of types of digital money are cryptocurrencies, central bank digital currencies, and stablecoins.

- Digital money is susceptible to hacks and can compromise user privacy. Investopedia

Will Jamaica be ready to become a cashless society in 20 years? The majority of the Jamaican society use cash on a day-to-day basis. Many Jamaicans cannot afford to have a bank account because they either do not have jobs to get the required documents to open an account or are paid in cash. Many cannot afford the fees to maintain a bank account. The major concerns are people in Jamaica could be forced into a system they either do not want to participate or do not have the financial means to participate. Other concerns are that if all your monetary assets are in digital form, not only that government can track all your money in real time, they can also seize it on command.